child tax credit 2022 qualifications

Non-Credit Instructor - 2022. Tax Credits 45 Knightsbridge Rd Ste 22 Piscataway NJ.

Publication 596 2021 Earned Income Credit Eic Internal Revenue Service

The IRS deadline for the 2022 tax year is April 18 2022 you can file for the child tax credit when you submit your income tax return.

. The IRS headquarters in Washington. Find out if you are eligible for the child tax credit or why you might not qualify. The first one applies to the.

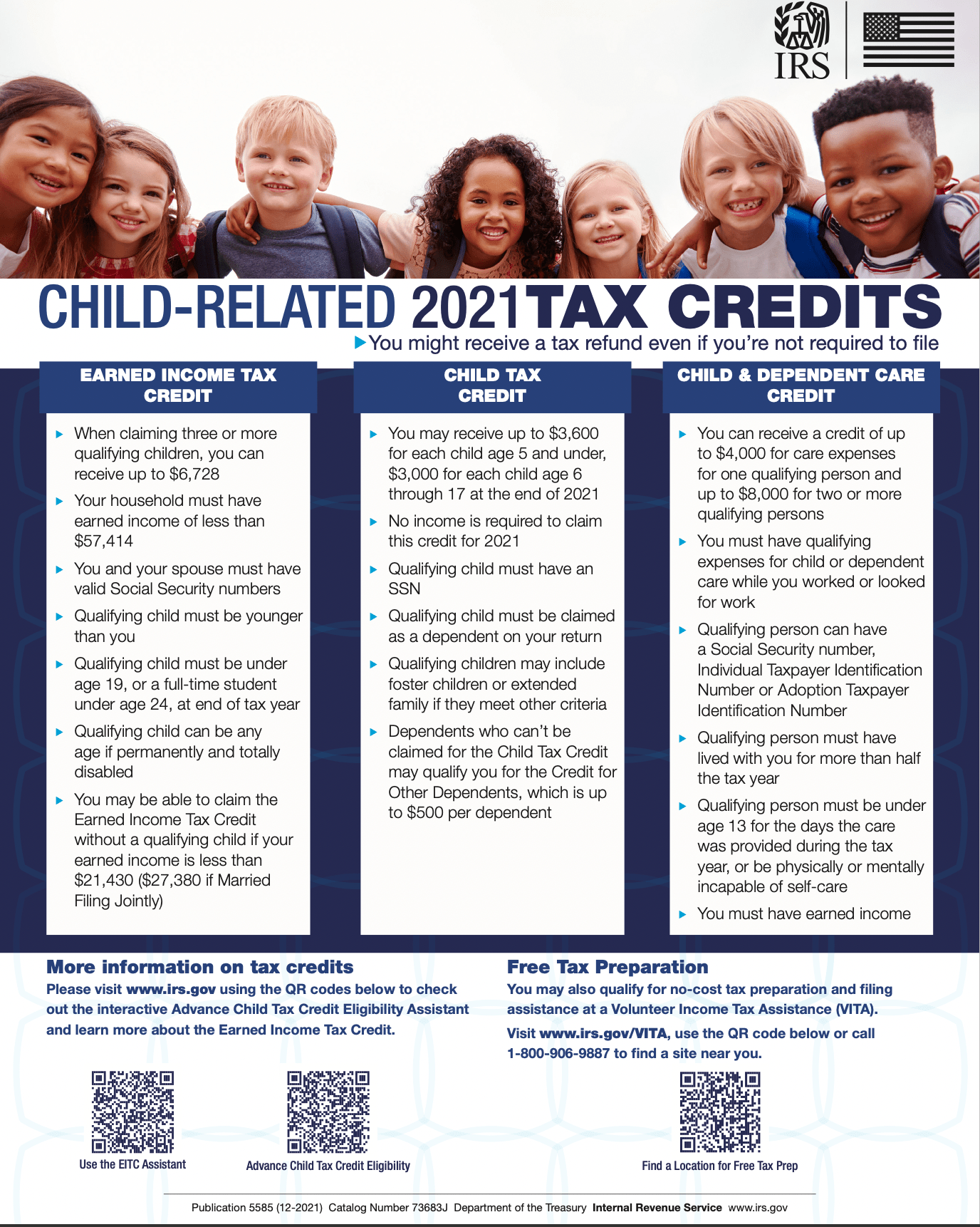

In 2020 eligible taxpayers could claim a tax credit of 2000 per qualifying dependent child under age 17. Through the 2021 Enhanced Child Tax Credit families were able to receive 3600 for children under 6 years of age and up to 3000 for children between ages 6 to 17. Click to call or view current TaX Credits promotions.

Tax Changes and Key Amounts for the 2022 Tax Year. For families with children who still. For Tax Years 2018-2020 the maximum refundable portion of the credit is 1400 equal to 15 of.

Free Phone Evaluation - Call 201 587-1500 212 380-8117 - Samuel C Berger PC is dedicated to serving our clients with a range of legal services including Earned Income. Be your own child adopted child. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of.

The maximum child tax credit amount will decrease in 2022. The American Rescue Plan Act which was enacted in March 2021 increased the amount of the Child Tax Credit from 2000 to 3000. Due to the American Rescue Plan Act.

Aug 22 2022 The child tax credit CTC will return to at 2000 per child in 2022Families must have at least 3000 in earned income to claim any portion of the credit and can receive a. Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit. Tax Pros Income Tax Service 441 North Ave Dunellen NJ.

From 2018 till 2020 an offset was worth 2000 per child for children aged up to 16 years or younger under the child credit tax. Eligible parents who missed out can still claim the money. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec.

We dont make judgments or prescribe specific policies. Child tax credit 2022 explained. Ad File a free federal return now to claim your child tax credit.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. The Child Tax Credit was only partially refundable prior to 2021 with this being up to 1400 per qualifying child and you needed at least 2500 of. Students with disabilities in SC qualify.

In 2021 millions of Americans received enhanced child tax credits but this year there are changes to. If the amount of the credit exceeded the tax that was owed the taxpayer. TaX Credits located in Piscataway caters to residents in and around the Morristown area.

The new advance Child Tax Credit is based on your previously filed tax return. Tax Pros Income Tax Service 213 Park Ave Plainfield NJ. See what makes us different.

Changes Made to Child Tax Credit in 2021. These FAQs were released to the public in Fact Sheet 2022-28PDF April. Information about qualifications of children income and age.

Parents with higher incomes also have two phase-out schemes to worry about for 2021. The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021. 17 hours agoA more generous child tax credit of up to 3600 per child was available last year.

The 2021 Child Tax Credit Information About Payments Eligibility

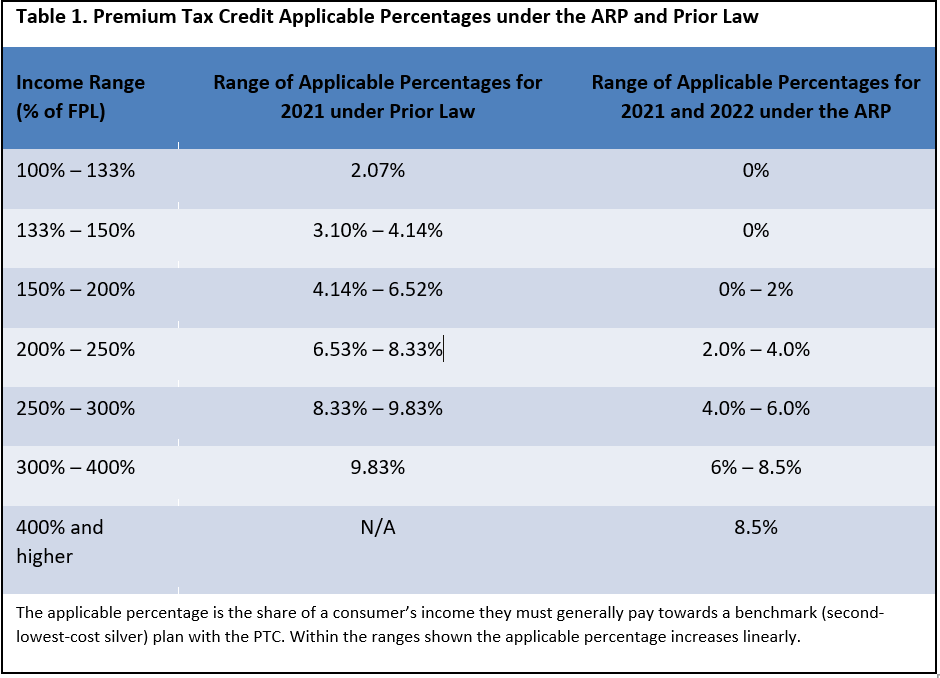

The American Rescue Plan S Premium Tax Credit Expansion State Policy Considerations

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Irs Form 2441 What It Is Who Can File And How To Fill It Out

Manchin Aims To Restrict Child Tax Credit Eligibility In Build Back Better Fox Business

Work Requirements For Child Tax Credits Are An Insult To Mothers Ms Magazine

The Child Tax Credit Grows Up To Lift Millions Of Children Out Of Poverty Tax Policy Center

Child Tax Credit 2022 Qualifications What Will Be Different Marca

10 Days Left Don T Leave Money On The Table This Tax Season Advocates For Ohio S Future

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

The Child Tax Credit What S Changing In 2022 Northwestern Mutual

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

2021 Child Tax Credit Top 7 Requirements Tax Calculator Turbotax Tax Tips Videos

You May Have Unclaimed Child Tax Credits Provo City School District

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit What We Do Community Advocates

Tax Rules For Claiming A Dependent Who Works The Official Blog Of Taxslayer